2024 Form 2210 Instructions. Scroll to the final page of the form to view the underpayment penalty worksheet. Your appeal rights and how to prepare a protest if you disagree :

This is the number of days the payment was late. In this section, we’ll go through each part of the form, step by step.

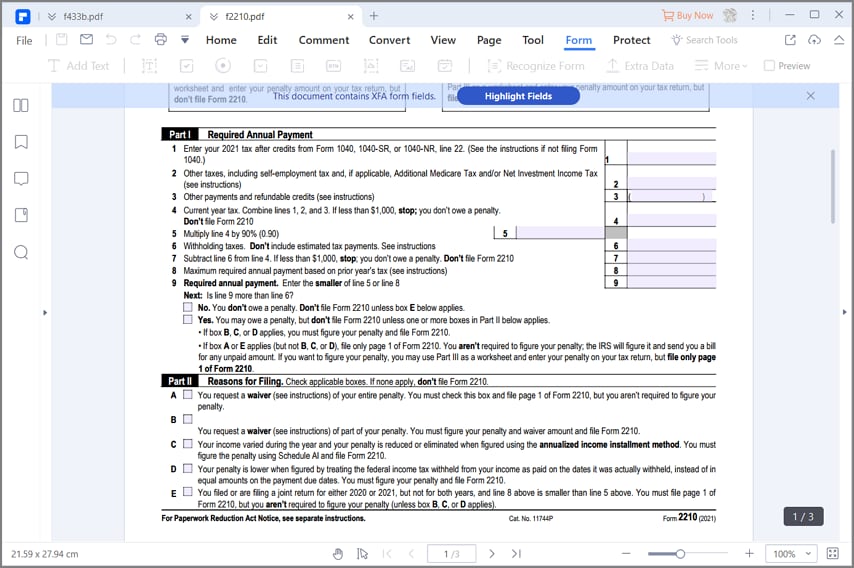

Attach Form 2210, Parts I, Ii, Iii, And Schedule Ai To Your Return.

The amount you owe for the tax year, after credits, is $1,000 or more.

If Your Income Varied During The.

Taxact cannot calculate late filing nor late payment penalties.

Publication 5 (Sp) Your Appeal Rights And How To.

Images References :

Source: www.dochub.com

Source: www.dochub.com

Form 2210 Fill out & sign online DocHub, Your appeal rights and how to prepare a protest if you disagree : An underpayment occurs when the taxes you paid through withholding and estimated tax payments are less than the minimum amount.

Source: www.teachmepersonalfinance.com

Source: www.teachmepersonalfinance.com

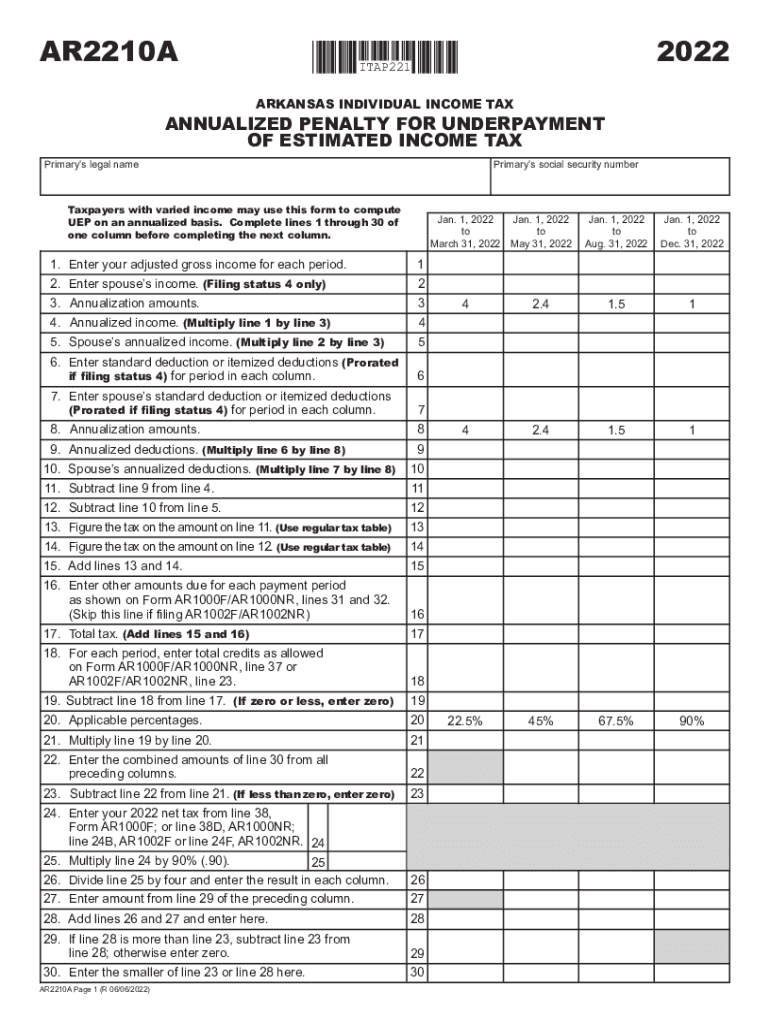

IRS Form 2210 Instructions Underpayment of Estimated Tax, Beginning with tax year 2023, certain applicable entities and electing taxpayers can elect to treat certain inflation reduction act of 2022 and creating helpful incentives to produce semiconductors act of 2022. This video briefly walks taxpayers through how to navigate schedule ai on irs form 2210.

Source: www.formsbank.com

Source: www.formsbank.com

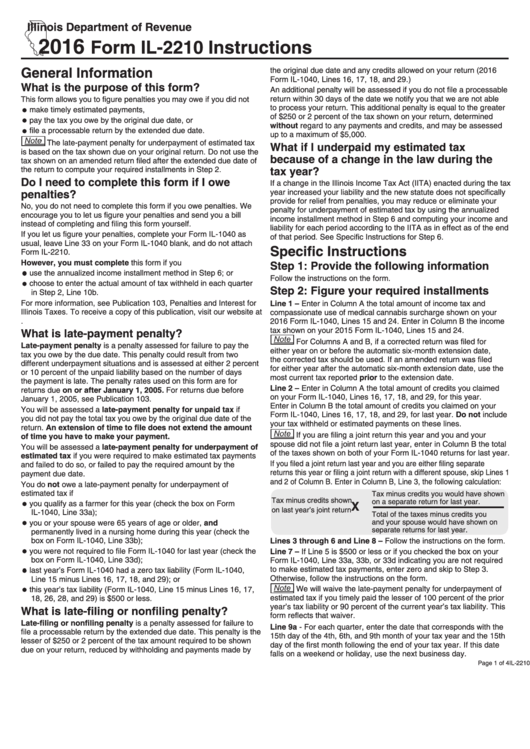

Form Il2210 Instructions 2016 printable pdf download, Form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of. What is irs form 2210?

Source: pdf.wondershare.fr

Source: pdf.wondershare.fr

Remplir le formulaire 2210 de l'IRS avec le meilleur remplisseur, What is irs form 2210? Scroll to the final page of the form to view the underpayment penalty worksheet.

Source: www.templateroller.com

Source: www.templateroller.com

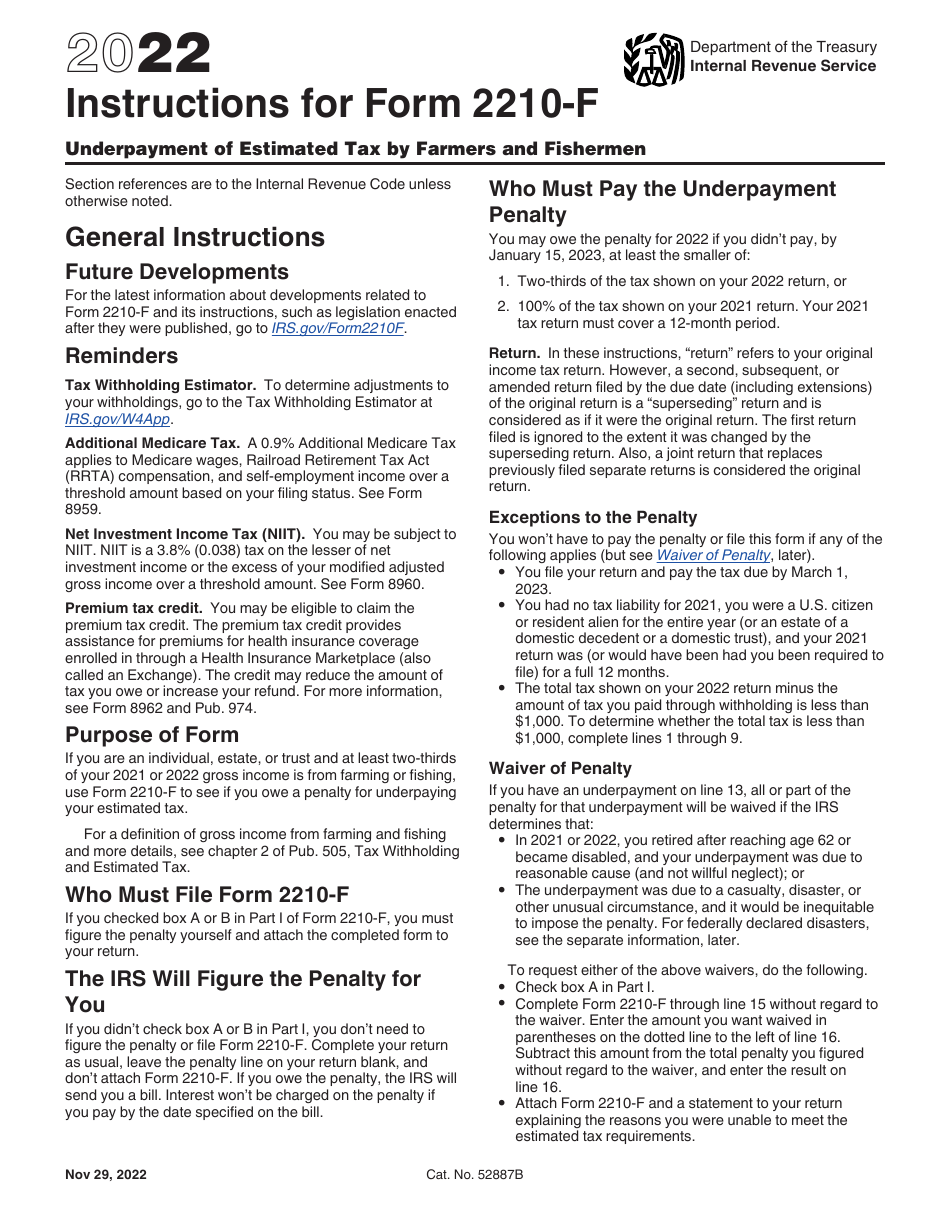

Download Instructions for IRS Form 2210F Underpayment of Estimated Tax, Your appeal rights and how to prepare a protest if you disagree : It’s officially titled “underpayment of.

Source: www.formsbank.com

Source: www.formsbank.com

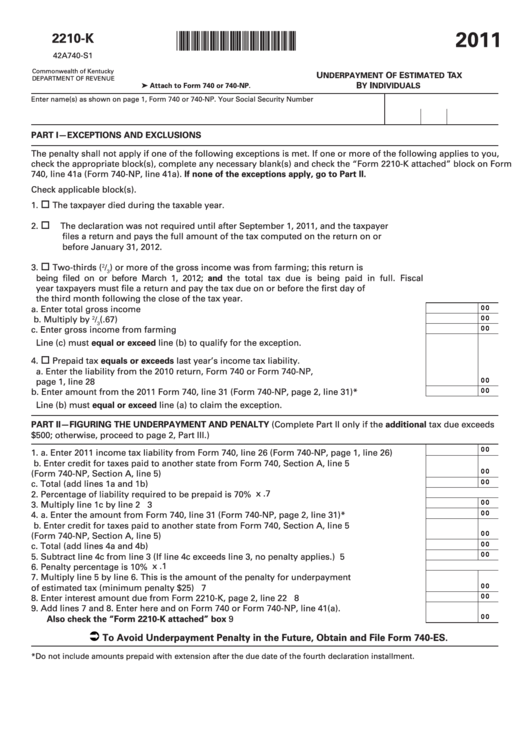

Fillable Form 2210K Underpayment Of Estimated Tax By Individuals, This is the number of days the payment was late. What tax form do you use for the annualized income installment method?

Source: www.formsbirds.com

Source: www.formsbirds.com

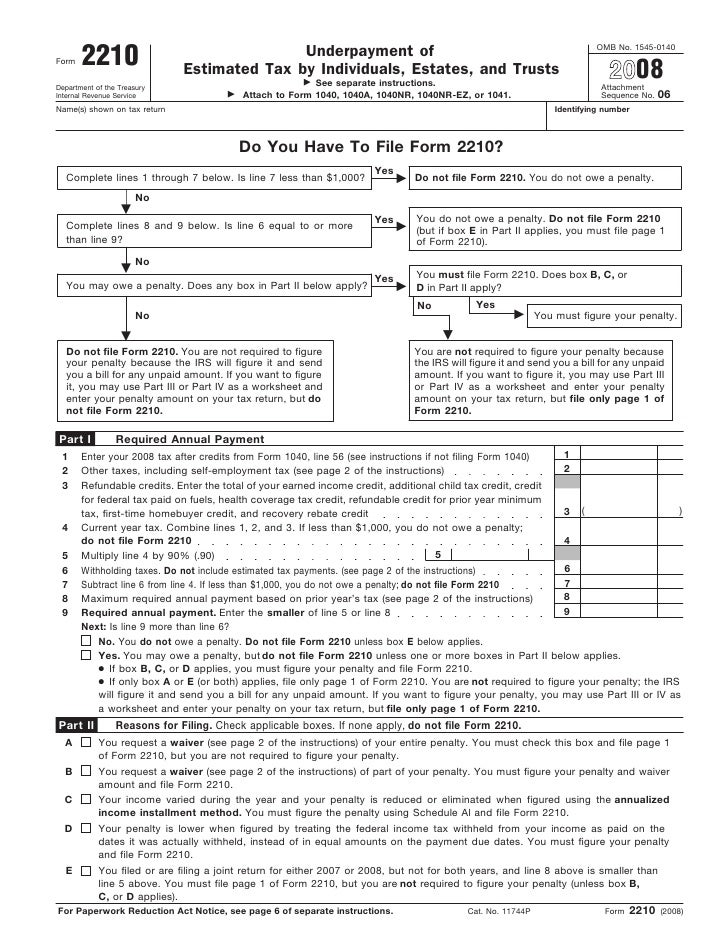

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and, Taxact cannot calculate late filing nor late payment penalties. An underpayment occurs when the taxes you paid through withholding and estimated tax payments are less than the minimum amount.

Source: www.slideshare.net

Source: www.slideshare.net

Form 2210Underpayment of Estimated Tax, You can use form 2210, underpayment of estimated tax by individuals,. Attach form 2210, parts i, ii, iii, and schedule ai to your return.

Source: www.signnow.com

Source: www.signnow.com

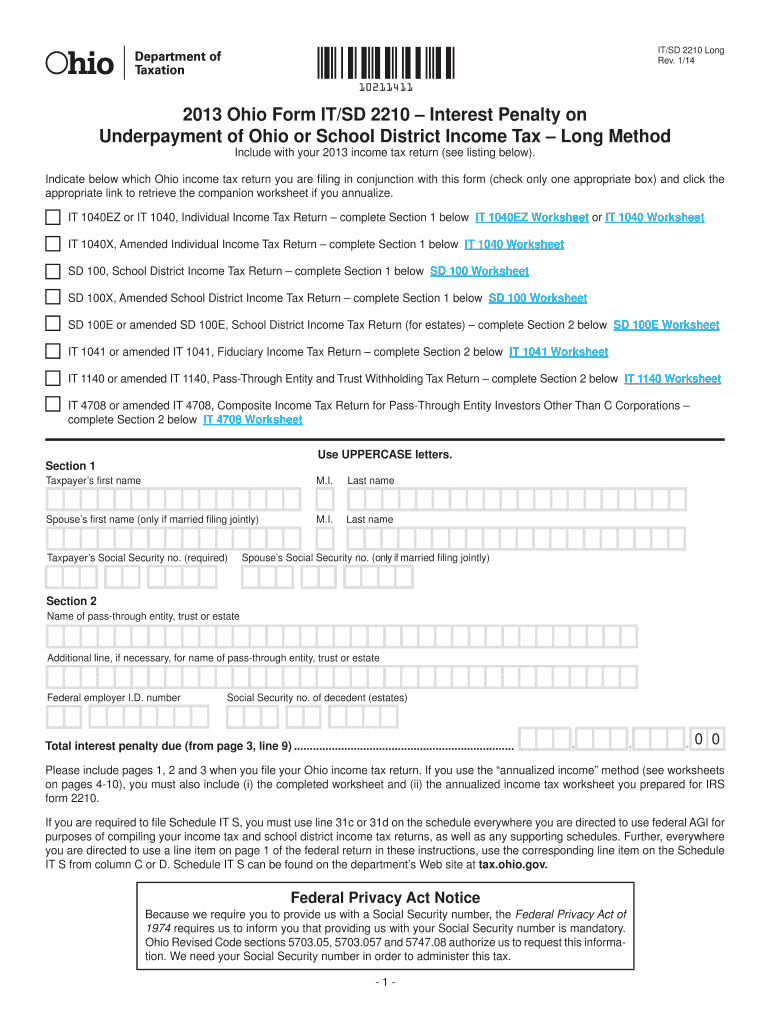

Ohio it Sd 2210 20162024 Form Fill Out and Sign Printable PDF, The current period begins july 1, 2023, and ends june 30,. This video briefly walks taxpayers through how to navigate schedule ai on irs form 2210.

Source: ar.cs-finance.com

Source: ar.cs-finance.com

تعليمات نموذج الضريبة الفيدرالية 2210 أساسيات 2023, The interest rate for underpayments, which is updated by the irs each quarter. Attach form 2210, parts i, ii, iii, and schedule ai to your return.

The Interest Rate For Underpayments, Which Is Updated By The Irs Each Quarter.

The irs tax form for underpayment of estimated tax by individuals, estates, and trusts is lengthy and complicated.

Scroll To The Final Page Of The Form To View The Underpayment Penalty Worksheet.

Publication 5 (sp) your appeal rights and how to.